- Independent contractor mileage reimbursement how to#

- Independent contractor mileage reimbursement drivers#

- Independent contractor mileage reimbursement software#

- Independent contractor mileage reimbursement plus#

Heads up: This deduction category does not include auto insurance and shouldn’t include any personal insurance. These insurance costs are all deductible. Have you purchased insurance for your self-employed business? This includes fire, theft, flood, malpractice, errors and omissions, general liability, and workers compensation. Sorry though, you can’t deduct parking tickets. This also includes parking fees and tolls. In lieu of taking the mileage deduction, you can deduct the business portion of your “actual car expenses” like big repairs, leasing payments for a car (primarily used for work), registration, maintenance, and car washes. One caveat for this deduction: Your travel must be “overnight, away from your residence, and be primarily for business.” 6. Just be careful to not deduct any personal expenses here like meals with friends while traveling. Have to travel to another city for work? Those travel costs like lodging, airfare, rental cars, and local transportation are deductible. Make sure you keep track of these expenses - they can add up to a lot at tax time. If it's something you use for both work and personal reasons, you'll need to keep track of how much the supply is used for each in some way. If you buy cleaning supplies, hot bags to keep food warm, doggie bags for dog walking, or any tools for your self-employed business, all of these supplies are deductible. Related: What to Do If You Haven't Been Tracking Your Business Expenses in 2021. Multiply that percentage by your rent, mortgage, and utility bills to calculate the amount you can deduct from your income.Īlternatively, you can do the simplified method: $5 for every square foot of home office space (up to 300 square feet). This can be done by estimating the square footage of your office as a percentage of your home’s overall square footage. If you work at home, identify the percentage of your home you use for your business.

Independent contractor mileage reimbursement how to#

Learn how to deduct health and medical expenses.

However, it’s important to understand the difference between these three kinds of tax opportunities.

Independent contractor mileage reimbursement plus#

There is a way for the same person to deduct medical expenses and insurance payments, plus get a subsidy for their insurance payments, all in the same year. You have a lot of options when it comes to deducting insurance and medical expenses. Health Insurance Premiums and Medical Costs (Deducted on Your Form 1040) The 2023 standard mileage rate is 65.5 cents per mile. As it turns out, the standard mileage rate is pretty generous unless you drive a gas guzzler.

Independent contractor mileage reimbursement drivers#

Option 2 is called the standard mileage deduction, and it usually saves drivers more money at tax time than itemizing all car expenses. It’s complicated, so most people choose Option 2, which involves tracking only your mileage. Option 1 involves tracking all the expenses you put toward your vehicle throughout the year and keeping track of a lot of receipts. Your actual car expenses, like the cost of gas, maintenance, insurance, car payments, and depreciation, orĪ standard amount for every mile you drive. You have two options when it comes to this 1099 deduction: Get it today!) Top 1099 Tax Write-Offsįirst on the 1099 deduction list for self-employed workers: Mileage.

(Don't forget, the FREE Stride app can help you save thousands of dollars on your tax bill and hours of tax prep time by automatically tracking your miles and expenses, surfacing money-saving deductions, and getting your forms IRS-ready.

Independent contractor mileage reimbursement software#

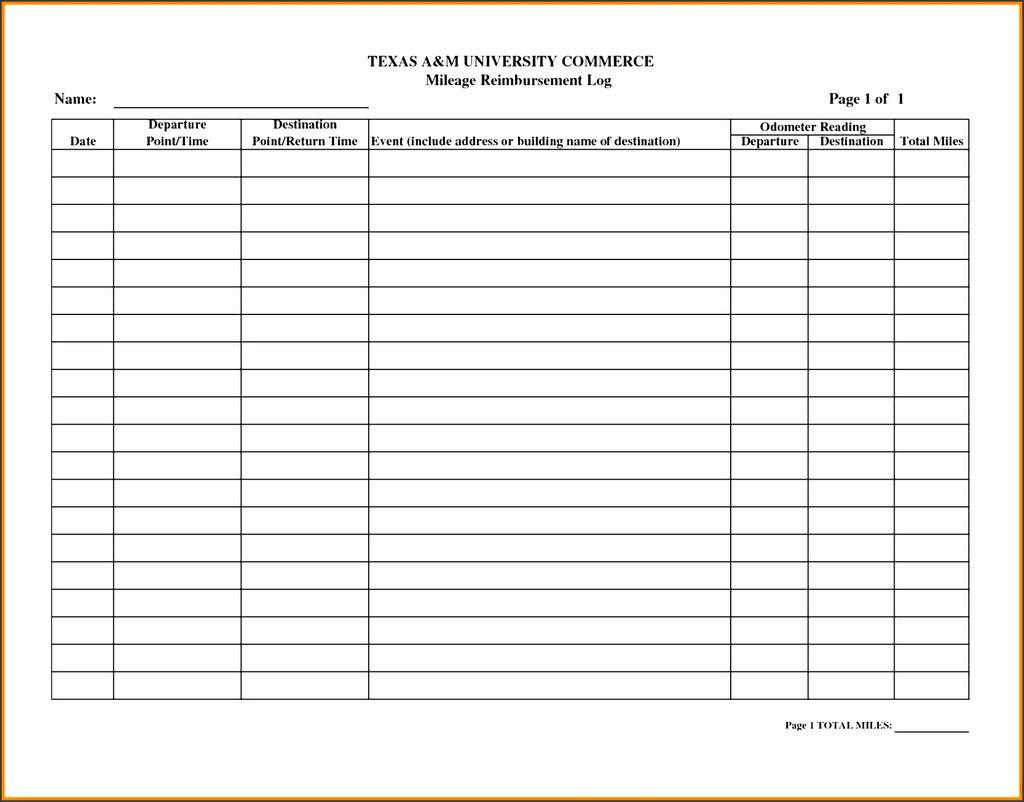

If you use software like TurboTax, the software will prompt you for the expense category totals and input them into the Schedule C for you. When you file in April, you’ll total these expenses per category and list them on your Schedule C (the Stride app does this math for you). Tip: As you track business expenses, make sure you keep proof in the form of receipts, bank statements, and mileage logs (or a tracking app like Stride).

0 kommentar(er)

0 kommentar(er)